W4 allowance calculator

Use the withholding calculator to fill out Form W-4 so you dont get a refund or owe any taxes. Head of Household.

How To Calculate Federal Withholding Tax Youtube

PAYucator - Paycheck W-4 Calculator.

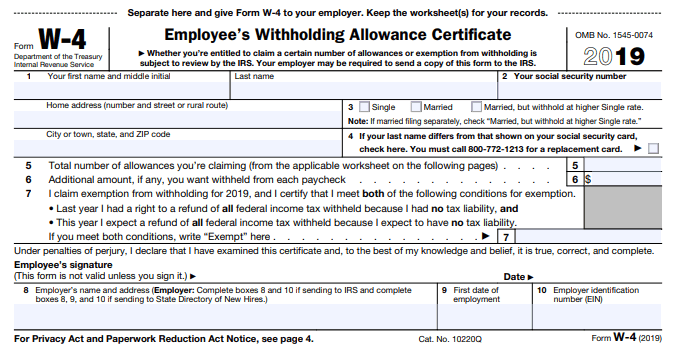

. Choose your rank and enter zip code to know your housing allowance. You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form depending on what youre eligible for. Form OR-W-4 line instructions Type or clearly print your name Social Security number SSN and mailing address.

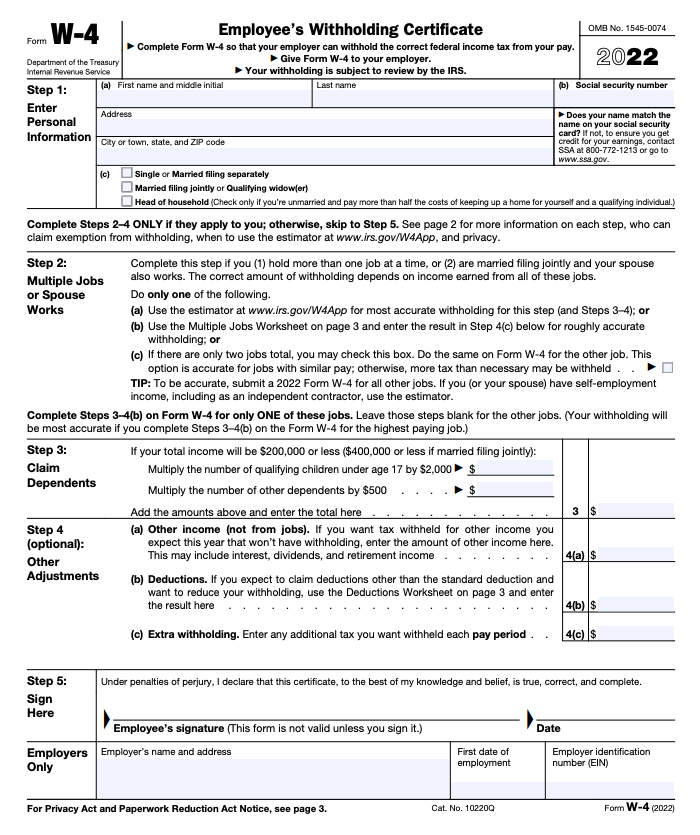

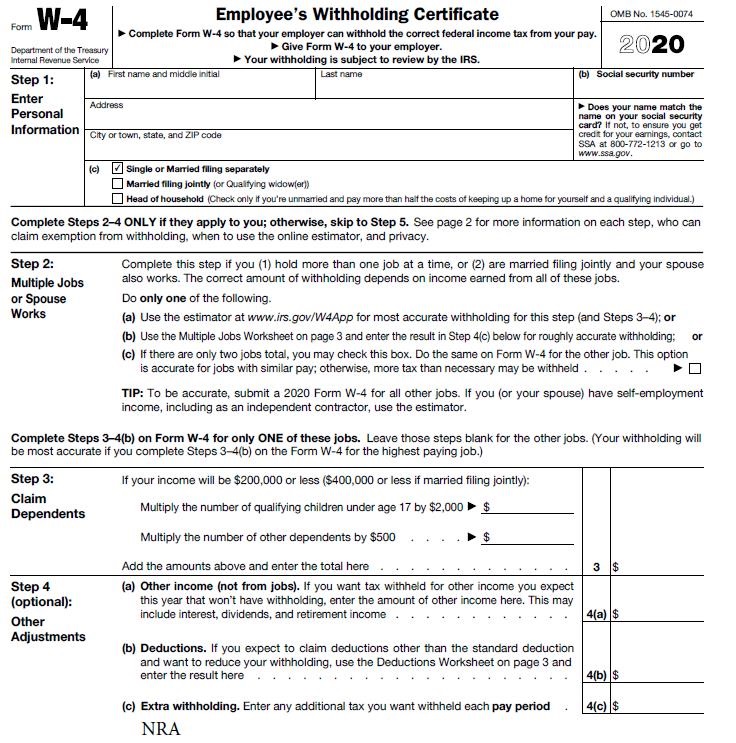

Single or Married Spouse Works. A great tool to help you while filling out a W-4 is the IRS Withholding Calculator located on the IRS website. 2022 W-4 Help for Sections 2 3 and 4.

Free Federal and Illinois Paycheck Withholding Calculator. You can no longer eFile your 2019 Tax Return. Free Federal and North Carolina Paycheck Withholding Calculator.

RATEucator - Income Brackets Rates. Check if You have filled out the Latest W4. NC-4 Allowance Worksheet Part II.

1 Job 2 Jobs 3 Jobs 4 or More Jobs. Switch to Colorado hourly calculator. Get 247 customer support help when you place a homework help service order with us.

If youre single with more than one job or if you and your spouse both work then refer to the Two-EarnersMultiple Jobs Worksheet. The more allowances you claimed on your Form W-4 the less income tax would be withheld from each paycheck. 2022 BAH Calculator shows your housing allowance based on your duty location rank and family status.

If you didnt claim enough allowances you overpaid in taxes and will get that amount back through a tax. Can you email me a duplicate of my tax document. A withholding allowance is a type of exemption that employees indicate when submitting their IRS Form W-4.

Due to privacy concerns we are unable to e-mail 1099R forms. You are presented with a tax refund amount from the output of our W-4 calculator and and your desired tax refund is 0. Form W-4 2022 Page 3 Step 2bMultiple Jobs Worksheet Keep for your records If you choose the option in Step 2b on Form W-4 complete this worksheet which calculates the total extra tax for all jobs on.

Check if Nonresident Alien. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado paycheck calculator.

Late Filing and late Payment Penalty Estimator Calculator. Generally the more allowances you claim the less tax will be withheld from each paycheck. Federal tax updates can only be done through Direct Access DA Self-Service or submitting the most recent version of the W4 form to ppc-dg-customercareuscgmil.

Subtract 1 allowance from the amount listed on lines A4 B15 or C5. W-4 Adjust - Create A W-4 Tax Return based. This 2019 Tax Calculator will help you to complete your 2019 Tax Return.

Copy and paste this code into your website. You should decrease your withholding if. Check if You have filled out the Latest W4.

Information about Form W-4 Employees Withholding Certificate including recent updates related forms and instructions on how to file. And both having jobs should claim. If you claim zero allowances that means you are having the most withheld from your paycheck for federal income tax.

This W4 calculator tool comes in handy when youre claiming head of household 2000 or more in child or dependent care expenses or eligibility for the Child Tax Credit. New Jersey Employees Withholding Allowance Certificate Form NJ-W4. This may not be possible in some cases.

W-4 Pro Select Tax Year 2022. Claiming zero allowances means less take home pay but a bigger tax refund during tax season. Or Married Filing Separate r Married Spouse does not work r.

Standard Allowance Go down the first column to your expected filing status from IRS Form W-4 Step 1c. The number you report on a W-4 will ultimately determine your take home pay and your tax refund. When you claim an allowance on your taxes you are telling the government that you are not qualified to pay that amount.

You must enter a SSN. The state doesnt have a withholding form equivalent to the federal Form W-4. Some people choose to have more taxes withheld so they will receive a tax refund.

Check if Nonresident Alien. If you expect to have a balance due as a result. You must file W-2 forms if you withheld any income social security or Medicare tax from wages regardless of the amount of wages You also must file if your employee claims more than one withholding allowance.

Illinois Form Il-W-4 Additional Allowance Worksheet. Filing Status from IRS Form W-4 Step 1c Standard Allowance for. 2022 BAH Rates By State and Local MHA AL AK AZ AR CA CO CT DE.

2022 W-4 Help for Sections 2 3 and 4. Dont claim exempt for having no tax liability or for the portion of your wages exempted under federal Form 8233. This Colorado hourly paycheck calculator is perfect for those who are paid on an hourly basis.

You should use a federal W-4 and write across the top of the form For New Mexico Withholding Tax Only. Dont write down any number. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

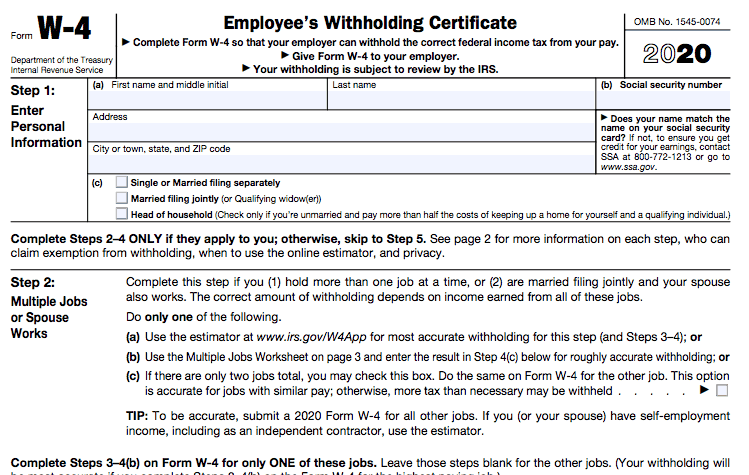

Form W-4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay. Prior to 2020 a withholding allowance was a number on your W-4 that your employer used to determine how much federal and state income tax to withhold from your paycheck. The withholding allowance choice on Form W4 is what will determine how much money will be taken out in taxes.

Use the Hourly Paycheck Calculator to find out what take-home wages are every pay period for hourly employees. Check the appropriate filling status below. IRS tax forms.

You are presented with an amount that you owe in taxes from the output of our W-4 calculator and your desired tax refund amount is 0. If your personal or financial situation changes for 2022 for example your job starts in summer 2021 and continues for all of 2022 or your part-time job becomes full-time you are encouraged to come back in early 2022 and use the calculator again. Switch to Colorado salary calculator.

Then go across that row to the column with the number of jobs that you and your spouse if filing jointly currently have. Basic Allowance for Housing BAH Calculator 2022. No the calculator assumes you will have the job for the same length of time in 2022.

2022 Tax Calculator Estimator - W-4-Pro. What happened to withholding allowance numbers on the W-4.

What S The New W 4 And How Does It Affect Me Aps Payroll

United States How To Answer Irs Withholding Calculator Questions About 2018 Personal Finance Money Stack Exchange

Irs Improves Online Tax Withholding Calculator

W 2 And W 4 What They Are And When To Use Them Bench Accounting

Solved 2020 W 4 Page 2

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Mobile Farmware Irs Form W 4 2020

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

How To Calculate Federal Income Tax

What S The New W 4 And How Does It Affect Me Aps Payroll

How Many Tax Allowances Should I Claim Community Tax

How To Fill Out A W4 2022 W4 Guide Gusto

How To Fill Out A W4 2022 W4 Guide Gusto

How To Fill Out The New W 4 Form Correctly 2020

W 4 Form Basics Changes How To Fill One Out

W 4 Form What It Is How To Fill It Out Nerdwallet