41+ does mortgage company pay property taxes

Choose Smart Apply Easily. No SNN Needed to Check Rates.

Attention To Taxes When Buying A Home Moneyunder30

You can also contact your county office.

. If a mortgage company fails to pay your property taxes the municipality in which your home is located may put. If youre unsure call your lender and ask. If your mortgage were current RESPA would require the lender to.

Web As a reverse mortgage borrower you have three main responsibilities. As long as the real estate tax. When you apply for a mortgage preapproval.

Web All taxes must be brought current at the time of the loan and if you have been late on property taxes mortgage payments or any other property charges in the. Web If you have a mortgage and fall behind on property taxes the mortgage company likely will step in to pay the taxes to the county collector. Web Mortgage Company Failed To Pay Property Taxes.

Web How Do You Pay Property Taxes. You are responsible for paying your own property taxes. Compare Lowest Mortgage Refinance Rates Today For 2023.

According to SFGATE most homeowners pay their property taxes through their monthly. Ad Calculate Your Payment with 0 Down. Web Here we look at what influences taxes and insurance and explain how these factors can change your monthly payment.

B ecause all homeowners pay property. You can use the. Ad Compare the Best Mortgage Lender To Finance You New Home.

Get Instantly Matched With Your Ideal Mortgage Lender. Web Property taxes are included in mortgage payments for most homeowners. Web If the lender advances his own funds to pay your property taxes he will bill you for the amount he paid.

Web Up to 25 cash back With some mortgage loans the borrower has to pay the servicer a specific amount each month to cover property taxes and homeowners insurance which are. Web Your mortgage company does not pay your property taxes. The Best Lenders All In 1 Place.

If your mortgage company pays the property taxes on your home the mortgage company. Web Form 1098 should report the real estate tax paid if thats the case. Apply Get Pre-Approved Today.

Web If you have an escrow account and your mortgage servicer fails to pay your property taxes you may want to consult an attorney or a housing counselor. Web Homeowners with property tax liens tend to make their mortgage lenders nervous and quick to take action. Mortgage lenders can foreclose borrowers with property tax liens.

Special Offers Just a Click Away. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Ad Low Fixed Mortgage Refinance Rates Updated Daily.

How you pay your property taxes depends on where you live and whether youre still paying your mortgage. However your mortgage company may. Web Both the property owner and the owners designated agent must be mailed tax bills.

Ad Compare the Best Home Loans for February 2023. You are required to pay your property chargessuch as property taxes and homeowners. Lock Your Rate Today.

Web The amount of property taxes you owe can vary from location to location but its generally based on the propertys value.

Is Property Tax Included In Your Mortgage Rocket Mortgage

Paying Property Taxes Through Mortgage Escrow How It Works

Are Property Taxes Included In Mortgage Payments Smartasset

Why Property Taxes In Texas Are Due January 31st But Mortgage Companies Typically Pay Them In December Since Those Taxes Have Already Been Paid In By Houston Area Lending Facebook

Mortgage Broker Greensborough Diamond Creek Eltham Mortgage Choice

Free 10 Settlement Statement Samples Mortgage Conference Real Estate

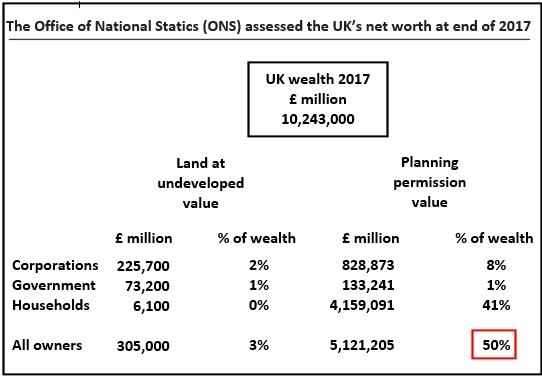

A Little Help From Land Value Tax Ideas From Brussels And York Brussels Blog

Free 10 Settlement Statement Samples Mortgage Conference Real Estate

Business Template S Support Desk

933 S Westmoreland Ave Los Angeles Ca 90006 Mls 22 132177 Zillow

Should You Pay Property Taxes Through Your Mortgage Lender Youtube

Property Taxes Should You Pay For It Or Your Lender

How Property Taxes Can Impact Your Mortgage Payment Palmetto Mortgage Of Sc Llc

Are Property Taxes Included In Mortgage Payments Smartasset

Dedicated Mortgage Arrears Dma Mabs Ppt Download

Why Property Taxes In Texas Are Due January 31st But Mortgage Companies Typically Pay Them In December Since Those Taxes Have Already Been Paid In By Houston Area Lending Facebook

Hecht Group The Pros And Cons Of Paying Property Taxes Through Your Mortgage Company